In the Union Budget 2025, Finance Minister Nirmala Sitharaman introduced significant reforms to India's income tax structure for the financial year 2025-26. Aimed at reducing the tax burden on middle-income earners and stimulating economic growth, these changes include an increase in the basic exemption limit and a restructuring of tax slabs.

Under the new tax regime, individuals with an annual income up to Rs 12 lakh are exempt from paying income tax. This adjustment is designed to enhance disposable income, thereby boosting household consumption and savings. Additionally, the standard deduction for salaried individuals has been increased to Rs 75,000, further reducing taxable income.

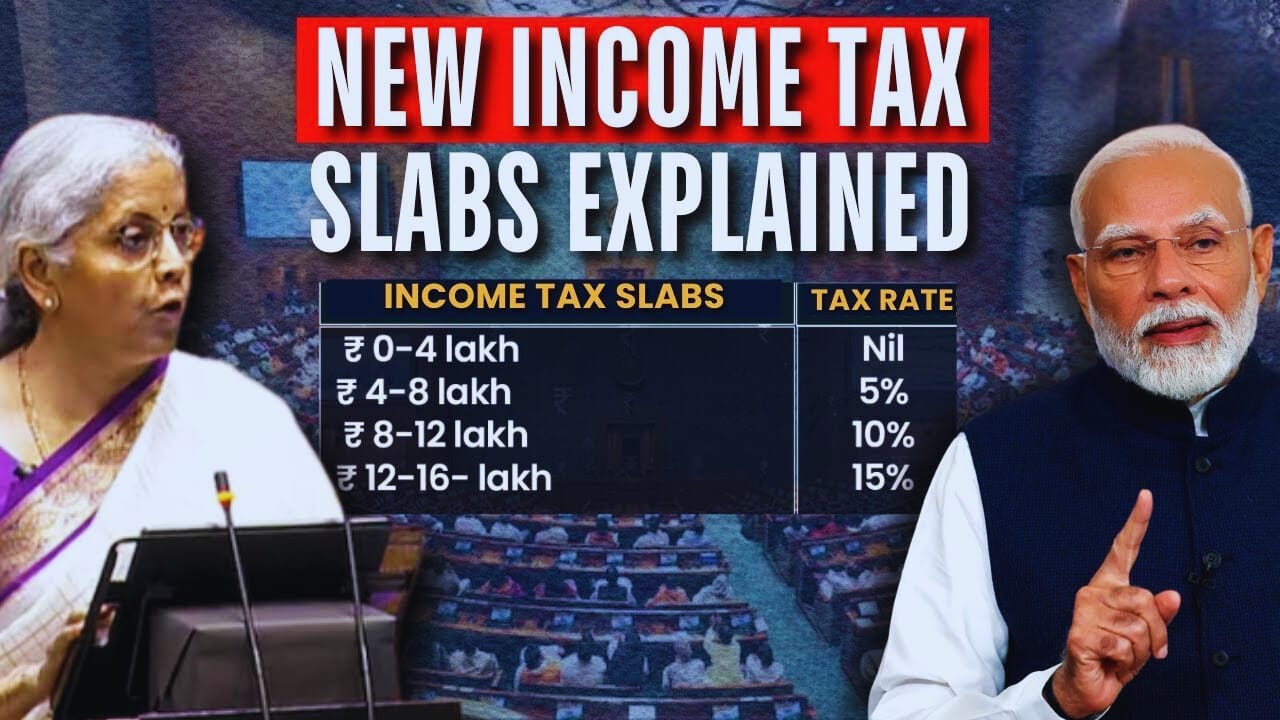

The revised tax slabs are as follows:

- Income up to Rs 4,00,000: Nil

- Rs 400,001 to Rs 800,000: 5%

- Rs 800,001 to Rs 1,200,000: 10%

- Rs 1,200,001 to Rs 1,600,000: 15%

- Rs 16,00,001 to Rs 20,00,000: 20%

- Rs 20,00,001 to Rs 24,00,000: 25%

- Above ₹24,00,000: 30%

These reforms aim to simplify the tax system and provide substantial relief to taxpayers, reflecting the government's commitment to fostering a more equitable and growth-oriented economic environment.

As a law student, it's essential to understand the implications of these changes, not only for individual taxpayers but also for the broader economic landscape. Analyzing the legal framework surrounding tax reforms can provide valuable insights into fiscal policy and its impact on society. Engaging with these developments critically will enhance your comprehension of tax law and its practical applications.

Key Highlights of the New Tax Regime:

Increased Basic Exemption Limit: The basic exemption limit has been raised to Rs 4 lakh, meaning individuals earning up to this amount are not liable to pay income tax.

Enhanced Standard Deduction: Salaried individuals can now avail a standard deduction of Rs 75,000, up from the previous Rs 50,000, reducing their taxable income.

Section 87A Rebate: Individuals with a net taxable income up to Rs 12 lakh are eligible for a rebate of Rs 60,000, effectively nullifying their tax liability.

Comparison with the Old Tax Regime:

The old tax regime offered various exemptions and deductions, such as those under Section 80C, 80D, and House Rent Allowance (HRA). In contrast, the new tax regime provides lower tax rates but with limited exemptions. Taxpayers can choose between the two regimes based on which offers greater tax benefits, considering their eligibility for deductions and exemptions.

Here's a comparison of the income tax slabs under the old and new tax regimes for the financial year 2025-26 (assessment year 2026-27):

Income Tax Slabs Comparison: Old vs. New Regime

|

Annual Income (₹) |

Old Tax Regime |

New Tax Regime |

|

Up

to ₹2,50,000 |

Nil |

Nil |

|

₹2,50,001 to ₹3,00,000 |

5% |

Nil |

|

₹3,00,001

to ₹4,00,000 |

5% |

Nil |

|

₹4,00,001 to ₹5,00,000 |

5% |

5% |

|

₹5,00,001

to ₹8,00,000 |

20% |

5% |

|

₹8,00,001 to ₹10,00,000 |

20% |

10% |

|

₹10,00,001

to ₹12,00,000 |

30% |

10% |

|

₹12,00,001 to ₹15,00,000 |

30% |

15% |

|

₹15,00,001

to ₹20,00,000 |

30% |

20% |

|

₹20,00,001 to ₹24,00,000 |

30% |

25% |

|

Above

₹24,00,000 |

30% |

30% |

Key Differences Between the Old and New Tax Regimes:

Basic Exemption Limit:

Old Regime: Rs 2.5 lakh for individuals below 60 years, Rs 3 lakh for senior citizens (60-80 years), and Rs 5 lakh for super senior citizens (above 80 years).

New Regime: Uniform Rs 4 lakh for all individuals, regardless of age.

Deductions and Exemptions:

Old Regime: Allows various deductions and exemptions, such as those under Section 80C (investments), 80D (medical insurance), House Rent Allowance (HRA), etc.

New Regime: Limited deductions; a standard deduction of Rs 75,000 is available, but many other exemptions are not.

Rebate Under Section 87A:

Old Regime: Available for individuals with net taxable income up to Rs 5 lakh, providing a rebate of up to Rs 12,500.

New Regime: Enhanced rebate for net taxable income up to Rs 12 lakh, providing a rebate of Rs 60,000, effectively making the tax liability zero for incomes up to Rs 12 lakh.

These changes aim to simplify the tax structure and provide relief to taxpayers, especially those in the middle-income bracket. Taxpayers should evaluate both regimes to determine which is more beneficial based on their income and eligible deductions.

Enhanced Tax Rebate Under Section 87A

In the Union Budget 2025, Finance Minister Sitharaman announced significant changes to India's income tax structure for the financial year 2025-26. One notable reform is the enhancement of the tax rebate under Section 87A. Previously, individuals with a net taxable income up to Rs 7 lakh were eligible for a rebate of Rs 25,000. Starting April 1, 2025, this threshold has been increased to Rs 12 lakh, with the rebate amount rising to Rs 60,000. This means that resident individuals earning up to Rs 12 lakh annually will have zero tax liability under the new tax regime. Salaried employees can benefit further, as the standard deduction has been increased to Rs 75,000, effectively raising the non-taxable income limit to Rs 12.75 lakh. It's important to note that this rebate applies only to income taxed under standard rates; incomes subject to special rates, such as capital gains, are excluded from this benefit. These reforms aim to reduce the tax burden on middle-income earners and simplify the tax system.

Standard Deduction and Other Key Deductions

The standard deduction for salaried individuals and pensioners under the new tax regime is rising from Rs 50,000 to Rs 75,000. This adjustment effectively raises the tax-free income threshold to Rs 12.75 lakh, considering the enhanced standard deduction. It's important to note that while the new tax regime offers this increased standard deduction, it does not permit other common exemptions and deductions, such as those under Section 80C (investments), Section 80D (medical insurance premiums), House Rent Allowance (HRA), and Leave Travel Allowance (LTA). Taxpayers must carefully evaluate which regime, new or old, aligns best with their financial situation, considering the availability of deductions and exemptions.

Comparison of Standard Deduction and Available Deductions:

|

Aspect |

Old Tax

Regime |

New Tax

Regime |

|

Standard

Deduction |

₹50,000 |

₹75,000 |

|

Section

80C Deductions |

Available

(e.g., investments in PPF, ELSS, LIC premiums) |

Not Available |

|

Section

80D Deductions |

Available

(e.g., medical insurance premiums) |

Not Available |

|

HRA

Exemption |

Available |

Not Available |

|

LTA

Exemption |

Available |

Not Available |

This table highlights the differences between the old and new tax regimes concerning standard deductions and other common exemptions. Taxpayers should assess their eligibility for various deductions and exemptions to determine which regime offers greater tax benefits.

Impact of Revised Surcharge Rates

In the Union Budget 2025-26, the Indian government introduced significant reforms to the income tax structure, aiming to reduce the tax burden on middle-income earners and stimulate economic growth. A notable change is the adjustment of surcharge rates for high-income individuals.

Key Highlights:

Surcharge Rates Unchanged: The highest surcharge rate of 25% on incomes exceeding Rs 2 crore remains unchanged under Budget 2025, maintaining the existing taxation structure for high-income earners.

Understanding Surcharge Rates:

Surcharge is an additional tax levied on the income tax amount for individuals earning above specified thresholds. It is designed to ensure that those with higher incomes contribute a fair share to the nation's revenue.

Surcharge Rates for FY 2025-26:

|

Income Range (₹) |

Surcharge Rate |

|

Up to 50 lakh |

Nil |

|

50 lakh to 1 crore |

10% |

|

1 crore to 2 crore |

15% |

|

Above 2 crore |

25% |

These rates apply uniformly under both the old and new tax regimes. It's important to note that the surcharge is calculated on the amount of income tax payable, not on the total income.

Implications for Taxpayers:

Middle-Income Earners: With the basic exemption limit raised to Rs 4 lakh and the enhanced rebate under Section 87A, individuals with a net taxable income up to Rs 12 lakh have no tax liability, as the rebate of Rs 60,000 effectively offsets their tax dues.

High-Income Earners: Those earning above 2 crore will continue to face a 25% surcharge on their income tax liability, maintaining the status quo from previous fiscal years.

These measures aim to balance tax relief for middle-income groups while ensuring that high-income individuals continue to contribute proportionately to the nation's finances.

Marginal Relief: Ensuring Fair Taxation

A notable change is the introduction of marginal relief for individuals whose income slightly exceeds the 12 lakh exemption limit.

Understanding Marginal Relief:

Marginal relief ensures that taxpayers do not pay more tax than the amount by which their income exceeds the 12 lakh threshold. This provision prevents a situation where a small increase in income results in a disproportionately higher tax liability.

How Marginal Relief Works:

For instance, consider an individual with a net taxable income of Rs 1,210,000. Without marginal relief, the tax liability would be calculated as follows:

- Income up to Rs 4,00,000: Nil

- Rs 4,00,001 to Rs 8,00,000: 5% of Rs 4,00,000 = Rs 20,000

- Rs 800,001 to Rs 1,200,000: 10% of Rs 400,000 = Rs 40,000

- Rs 12,00,001 to Rs 12,10,000: 15% of Rs 10,000 = Rs 1,500

Total Tax Without Marginal Relief: Rs 20,000 + Rs 40,000 + Rs 1,500 = Rs 61,500

However, since the individual's income exceeds the 12 lakh exemption limit by only Rs 10,000, marginal relief ensures that the tax payable does not exceed this excess amount. Therefore, the tax liability is limited to Rs 10,000.

Tax Liability with Marginal Relief:

|

Net Taxable Income (₹) |

Tax Without Marginal Relief (₹) |

Tax Payable with Marginal Relief (₹) |

|

12,10,000 |

61,500 |

10,000 |

|

12,50,000 |

67,500 |

50,000 |

|

12,70,000 |

70,500 |

70,000 |

|

12,75,000 |

71,250 |

71,250 (No

marginal relief) |

This table illustrates that as the income increases beyond 12 lakh, the tax payable rises; however, marginal relief ensures that the tax does not exceed the additional income over 12 lakh. Once the income reaches Rs 12,75,000, marginal relief is no longer applicable, and standard tax calculations apply.

These reforms aim to provide equitable tax treatment, ensuring that individuals with incomes slightly above the exemption limit are not unduly penalized.

Tax Planning Strategies for FY 2024-25

A key highlight is the increase in the basic exemption limit from 3 lakh to 4 lakh, meaning individuals earning up to 4 lakh annually are not liable to pay income tax. Additionally, the tax rebate under Section 87A has been enhanced, allowing individuals with a net taxable income up to 12 lakh to avail a rebate of Rs 60,000, effectively reducing their tax liability to zero. For salaried individuals, the standard deduction has been increased to Rs 75,000, further elevating the non-taxable income threshold to 12.75 lakh. These reforms are designed to simplify the tax system and provide substantial relief to taxpayers, reflecting the government's commitment to fostering a more equitable and growth-oriented economic environment.

Revised Income Tax Slabs for FY 2025-26:

|

Annual Income (₹) |

Tax Rate |

|

Up to ₹4,00,000 |

Nil |

|

₹4,00,001 to ₹8,00,000 |

5% |

|

₹8,00,001 to

₹12,00,000 |

10% |

|

₹12,00,001 to ₹16,00,000 |

15% |

|

₹16,00,001 to

₹20,00,000 |

20% |

|

₹20,00,001 to ₹24,00,000 |

25% |

|

Above ₹24,00,000 |

30% |

These adjustments aim to increase disposable income for middle-class taxpayers, thereby boosting consumption and savings. Taxpayers are encouraged to assess their financial situations to determine how these changes impact their tax liabilities.

Tax Benefits for Different Categories of Taxpayers (Rs 0-24 Lakhs)

The new tax regime for FY 2025-26 introduces several changes aimed at providing tax relief to different income groups. With revised tax slabs and increased rebates, individuals earning up to ₹12 lakh can benefit significantly, with no tax liability due to the enhanced rebate under Section 87A. Additionally, those earning between ₹12 lakh and ₹24 lakh will experience reduced tax rates, ensuring more savings compared to the previous tax system.

The table below provides a comparative view of the tax calculations under existing and proposed tax rates, showing the benefits taxpayers receive at different income levels. It highlights the tax payable under the new regime, illustrating how middle-income groups stand to gain from these reforms. This structured comparison will help taxpayers better understand how the revised tax system impacts them and aids in making informed financial decisions.

Now, let's look at the detailed tax benefits across various income categories

|

Total Income Column: 1 |

Tax Calculation (Existing Rates) Column: 2 |

Tax Calculation (Proposed Rates) Column: 3 |

Benefit from Revised Rates Column: 4 = Column: 3 - Column: 2 |

Rebate Advantage Column: 5 |

Overall Benefit Compared to Current Rates Column: 6 = Column 4 + Column 5 |

Tax Payable Under New Regime Column: 7" |

|

8 lakh |

30000 |

20000 |

10000 |

20000 |

30000 |

0 |

|

9 lakh |

40000 |

30000 |

10000 |

20000 |

40000 |

0 |

|

10 lakh |

50000 |

40000 |

10000 |

20000 |

40000 |

0 |

|

11 lakh |

66000 |

50000 |

16000 |

50000 |

66000 |

0 |

|

12 lakh |

80000 |

60000 |

20000 |

60000 |

60000 |

0 |

|

13 lakh |

100000 |

75000 |

25000 |

0 |

25000 |

75000 |

|

14 lakh |

120000 |

90000 |

30000 |

0 |

30000 |

90000 |

|

15 lakh |

140000 |

105000 |

35000 |

0 |

35000 |

105000 |

|

16 lakh |

170000 |

120000 |

50000 |

0 |

50000 |

120000 |

|

17 lakh |

200000 |

140000 |

60000 |

0 |

60000 |

140000 |

|

18 lakh |

230000 |

160000 |

70000 |

0 |

70000 |

160000 |

|

19 lakh |

260000 |

180000 |

80000 |

0 |

80000 |

180000 |

|

20 lakh |

290000 |

200000 |

90000 |

0 |

90000 |

200000 |

|

21 lakh |

320000 |

225000 |

95000 |

0 |

95000 |

225000 |

|

22 lakh |

350000 |

250000 |

100000 |

0 |

100000 |

250000 |

|

23 lakh |

380000 |

275000 |

105000 |

0 |

105000 |

275000 |

|

24 lakh |

410000 |

300000 |

110000 |

0 |

110000 |

300000 |

|

25 lakh |

440000 |

330000 |

110000 |

0 |

110000 |

330000 |

|

50 lakh |

1190000 |

1080000 |

110000 |

0 |

110000 |

1080000 |

How is income up to 12 lakh tax-free?

Under the new tax regime, individuals earning up to 12 lakh annually will have zero tax liability due to the enhanced Section 87A rebate. This tax relief is achieved through a structured tax slab system that ensures fair taxation while maximizing savings for middle-income earners.

Breakdown of Tax Calculation for ₹12 Lakh Income

- Income up to 4 lakh– No tax

- 4 lakh to 8 lakh – 5% tax = 20,000

- 8 lakh to 12 lakh – 10% tax = 40,000

- Total tax liability – 60,000

However, due to the Rs 60,000 rebate under Section 87A, the entire tax liability is wiped out, effectively making income up to 12 lakh completely tax-free.

Examples for Different Income Levels

Example 1: 15 Lakh Annual Income

- New tax regime– Tax payable is Rs 1,40,000

- Old tax regime – Tax payable was Rs 2,62,500

- Savings – Rs 1,22,500

Example 2: 18 Lakh Annual Income

- New tax regime – Tax payable is Rs 1,60,000

- Old tax regime – Tax payable was Rs 3,12,000

- Savings – Rs 1,52,000

Example 3: 25 Lakh Annual Income

- New tax regime – Tax payable is Rs 4,40,000

- Old tax regime – Tax payable was Rs 5,62,500

- Savings – Rs 1,22,500

frequently asked questions

What are the new income tax slabs for FY 2025-26?

The revised tax slabs under the new regime are:

- Up to Rs 400,000: Nil

- Rs 400,001 to Rs 800,000: 5%

- Rs 800,001 to Rs 1,200,000: 10%

- Rs 1,200,001 to Rs 1,600,000: 15%

- Rs 16,00,001 to Rs 20,00,000: 20%

- Rs 20,00,001 to Rs 24,00,000: 25%

- Above ₹24,00,000: 30%

How does the Section 87A rebate apply under the new tax regime?

Individuals with a net taxable income up to 12 lakh are eligible for a rebate of Rs 60,000, effectively reducing their tax liability to zero.

What is the standard deduction for salaried individuals in FY 2025-26?

The standard deduction has been increased to Rs 75,000, allowing salaried individuals to reduce their taxable income accordingly.

Can taxpayers still opt for the old tax regime?

Yes, taxpayers have the option to choose between the old and new tax regimes based on which is more beneficial for their financial situation.

Are common deductions like Section 80C available under the new tax regime?

No, the new tax regime offers lower tax rates but does not allow common deductions such as those under Section 80C, 80D, HRA, etc.

How does the new tax regime benefit middle-income earners?

With the increased exemption limit and revised tax slabs, middle-income earners can experience significant tax savings, enhancing their disposable income.

What is marginal relief, and how does it apply?

Marginal relief ensures that taxpayers do not pay more tax than the amount by which their income exceeds the 12 lakh threshold, preventing a disproportionate tax burden.

Are there any changes to surcharge rates in the new tax regime?

No, the surcharge rates remain unchanged, with the highest surcharge of 25% applicable to incomes exceeding ₹2 crore.

How does the new tax regime impact senior citizens?

The new tax regime applies uniformly to all individuals, regardless of age, with a basic exemption limit of 4 lakh.

When do the new tax slabs come into effect?

The revised tax slabs are applicable for the financial year 2025-26, starting from April 1, 2025.